The Real Cost of Car Detailing and Grooming

Most people will lose $154,000 in the next 10 years and never notice. Not from rent. Not from emergencies. From car washes, haircuts, and nails. This is how wealth dies quietly, comfortably, $100 at a time.

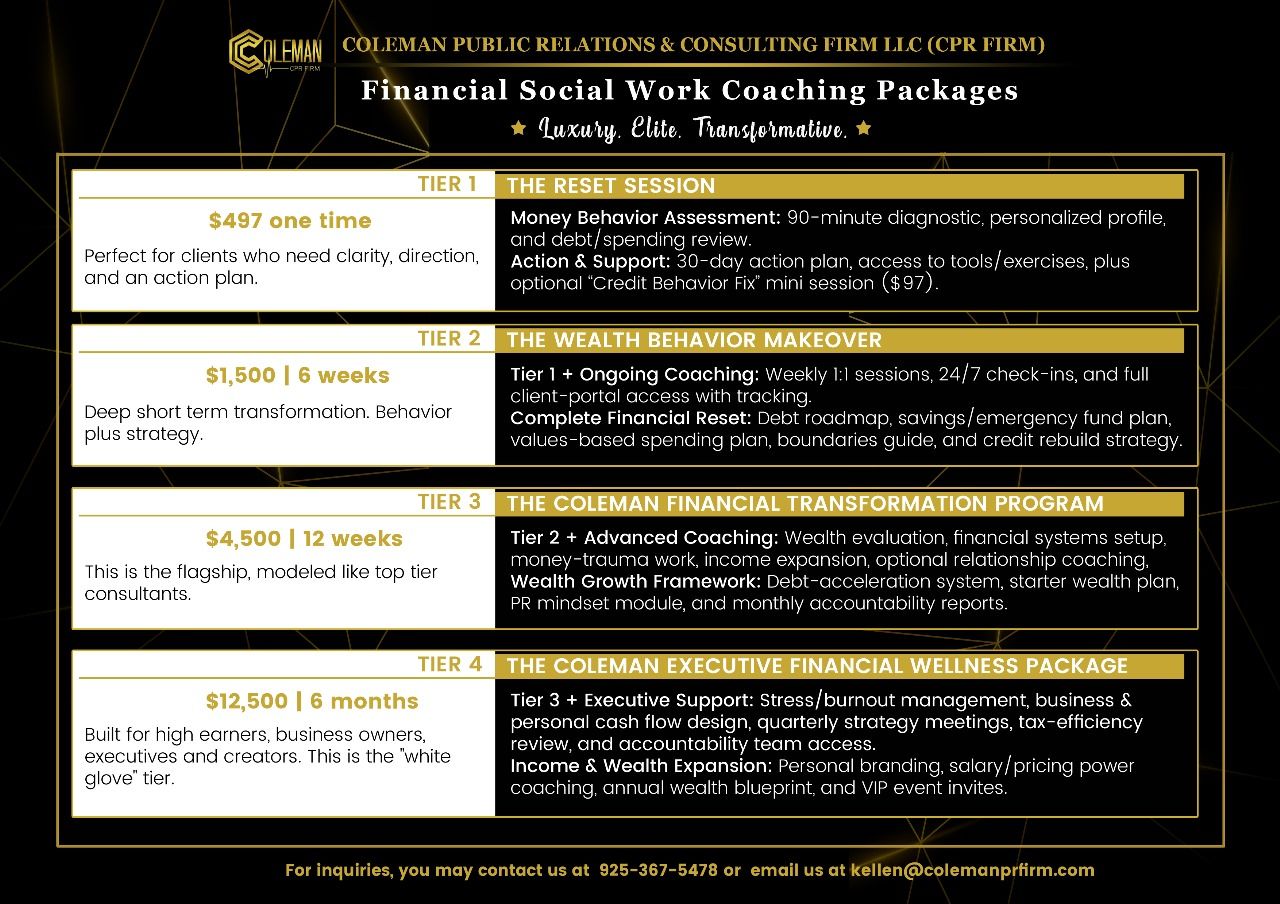

I'm writing this as a certified financial social worker coach from an accredited program at https://financialsocialwork.com/. My goal is to help you for free, and if you need more help, we have packages designed to elevate your financial future contact [email protected].

People swear they have a money problem. They do not. They have a lifestyle leak. A slow, quiet drip that drains six figures while they smile, look good, and stay stuck.

Let's break down the truth.

Car detailing

Palm Beach County average: $100 per car Two cars: $200 per visit Twice a month becomes: $200 × 2 = $400 per month $400 × 12 = $4,800 per year

Men's haircuts

Average: $50 per cut Every 2 weeks: $50 × 2 = $100 per month $100 × 12 = $1,200 per year

Every week: $50 × 4 = $200 per month $200 × 12 = $2,400 per year

Women's hair

Average: $150 per month Yearly: $150 × 12 = $1,800 per year

Nails

Average visit: $90 Most go twice a month Monthly: $90 × 2 = $180 per month Yearly: $180 × 12 = $2,160 per year

Yearly lifestyle money that evaporates:

Car detailing: $4,800 Men's grooming: $1,200 to $2,400 Women's hair and nails: $3,960

Total annual burn rate: $7,000 to $10,000 per year

This is where it gets ugly.

What happens when this money is invested at 7 percent

These projections assume a 7% average annual return, historically conservative for a diversified index fund over decades. Your mileage may vary, but the principle holds: small money, compounded, becomes life changing money.

Car detailing invested $4,800 per year at 7% 5 years ≈ $28,000 10 years ≈ $66,000

Men's haircut money invested $1,200 per year 10 years ≈ $16,500

Or $2,400 per year 10 years ≈ $33,200

Women hair plus nails invested $3,960 per year 10 years ≈ $55,000

Ten year total wealth lost: $154,200

Lost in 10 years. On grooming. On comfort. On looking good for people who will forget you by Friday.

What $7,000 to $10,000 per year becomes at 7 percent

This is the part people refuse to look at.

20 years

If you invest $7,000 per year: $287,000 If you invest $10,000 per year: $410,000

Nearly half a million dollars. From small comforts.

30 years

If you invest $7,000 per year: $668,000 If you invest $10,000 per year: $954,000

The numbers are now strangling.

40 years

If you invest $7,000 per year: $1,339,000 If you invest $10,000 per year: $1,912,000

Millionaire territory. From cutting habits. Not needs. Wants.

Final punchline

Could you use an extra $154,000 right now? Or do you need to look good?

The real enemy

It was never the barber. Never the detailer. Never the nail tech.

It was the habit. The automatic spending. The lack of ownership. And the lie that "it's just $100."

This is how wealth dies. Quietly. Comfortably. While you look amazing and stay broke.

Track your spending for 30 days. Find your leak. Then ask yourself: would you rather have $100 in your pocket today, or $200,000 in your account in 20 years?

The math doesn't care about your answer. But your future will.

Few Books That Could Help:

1. The Total Money Makeover by Dave Ramsey

Still the undisputed king of simple, brutal, practical money discipline.

Ramsey is all about killing lifestyle creep, killing debt, and mastering cash flow.

2. The Intelligent Investor by Benjamin Graham

Warren Buffett calls this the best investment book ever written.

It teaches long term thinking, compounding, and avoiding emotional spending.

Perfect for your message.

3. Think and Grow Rich by Napoleon Hill

A mindset classic. Not about saving itself, but about the habits and discipline that make saving possible.

This ties directly into the psychology behind wants versus needs.

4. Everyday Millionaires by Chris Hogan

5. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

6. The Wealth Choice by Dr. Dennis Kimbro

7. Rich Dad Poor Dad by Robert Kiyosaki

Still one of the best frameworks for understanding assets versus liabilities.

Your lifestyle leak angle lines up perfectly with this book’s message.

8.Black Fortunes by Shomari Wills

9. The Miseducation of the Negro by Carter G. Woodson Not a finance book

But one of the deepest analyses of how conditioning shapes spending, identity, and survival choices.

Need More help Contact [email protected] 925.367.5478